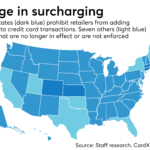

With 45 states now allowing merchants to pass along fees of up to 4 percent for the use of credit cards, the switch to so-called “surcharging” has officially taken on movement status. According to Payroc’s VP of Operations Evan O’Brien, once increasingly informed merchants and consumers have the conversation about these charges, they never look back.

“SMBs are really tired of paying for everyone’s free airline miles or free nights in hotel rooms,” O’Brien said in a recent chat with PYMNTS. “So [surcharging] is giving both the merchant and the consumer the option to kind of choose their own destiny.”

Since Payroc launched its RewardPay platform two years ago, which allows merchants to choose the percentage split they’re comfortable with for credit card transactions, O’Brien said it is starting to become the norm rather than the exception.

“I can count on both hands the number of merchants that have asked to switch back to a more traditional pricing structure, and that really comes down to how we implement it and our training, which includes instructions to merchants and staff so they’re able to comfortably and confidently explain the ‘why’ behind the surcharging decision,” he explained.

The Surcharge Movement

“You can really see that it’s a movement – and I think it’s going to become the norm,” predicted O’Brien. “Especially once it’s available nationwide, I think you’re going to see national chains enable it immediately.”

For example, if a national chain had an overall effective 3 percent cost rate for its payments processing, but was concerned about alienating longstanding customers, it could do a 50-50 split of the costs, with 1.5 percent borne by the consumer and the same by the merchant. And, of course, this would only apply to credit transactions, since there is no fee for debit or prepaid transactions. “That [fee split] is something that no one else is able to do,” O’Brien noted.

By giving consumers the option to avoid a surcharge by not using their credit card (and pre-notifying them of this option), and by allowing merchants to choose a fee split ratio they’re comfortable with, both sides are empowered and avoid unwelcome surprises.

“Payroc believes there should be no bait and switch. We don’t want somebody to fall in love with something and then find out that, ‘oh my gosh, I can’t pay for this with my credit card,’” explained O’Brien. “We don’t want any consumer or merchant to feel trapped into having to do something, so that’s why we do those notifications – to get that buyer’s remorse out of the way, even before checkout.”

Bringing Healthcare On Board

O’Brien said one of the main reasons that some large enterprises and brands have hesitated at the use of surcharges is because there are still five remaining states that do not allow it. According to O’Brien, two years ago, the number was 10 – and out of those 10 [states], Florida, California and Texas have all recently pulled down their restrictions on surcharging. The momentum points to a way forward for increased use of cost-sharing in more industries, including eCommerce and healthcare.

“It seems that every website you go to, you’ve got to click to accept something,” said O’Brien. “We can also build [surcharging] into your platform, where [customers] click to accept a 3.5 to 4 percent surcharge for credit card transactions,” unless they choose to use debit or prepaid cards.

The same goes for bringing healthcare into the world of digital payments, which has earned the dubious distinction as a laggard when it comes to collecting co-pays and such – let alone advancing the concept of surcharging with patients who, for whatever reason, prefer to pay with a credit card.

“It’s not just the interchange fees and the acquirer fees that cost the practice – it’s the mailed invoices and the restrictive times to pay off their balances,” said O’Brien. “Imagine if Amazon was only open from 7:00 a.m. to 4:00 p.m., Monday through Friday.”

Through the firm’s recently launched Payroc Health Group, O’Brien said that medical practitioners – whether they choose to surcharge for credit or not – are able to realize many other benefits, including less money wasted on mailed invoices, text-to-pay and online payments that automatically post to a patient’s ledger, as well as the ability to do business 24/7.

“It’s not just eliminating the processing fees, but also helping to streamline that back office,” he explained. “It also builds trust between the patient and the practice, and avoids those awkward financial talks or games of phone tag.”

O’Brien said that a lot of SMBs don’t pay close attention to their “cost of goods sold,” even though merchant processing fees are often the third or fourth highest expense a business faces, behind things like payroll, rent and materials. For example, a merchant processing $50,000 a month – half of which was paid by credit card – translates to about $850 in savings per month, or $10,000 annually.

“The possibilities are really endless for the merchant,” said O’Brien.